Learn about DROP.

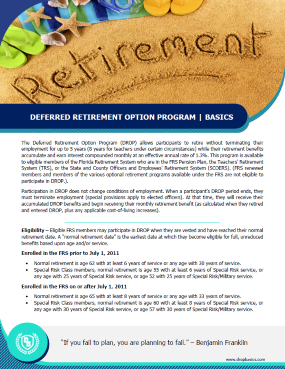

The Deferred Retirement Option Program (DROP) allows participants to retire without terminating their employment for up to 5 years (8 years for teachers under certain circumstances) while their retirement benefits accumulate and earn interest compounded monthly at an effective annual rate of 1.3%. This program is available to eligible members of the Florida Retirement System who are in the FRS Pension Plan, the Teachers’ Retirement System (TRS), or the State and County Officers and Employees’ Retirement System (SCOERS). (FRS renewed members and members of the various optional retirement programs available under the FRS are not eligible to participate in DROP.).

Participation in DROP does not change conditions of employment. When a participant’s DROP period ends, they must terminate employment (special provisions apply to elected officers). At that time, they will receive their accumulated DROP benefits and begin receiving their monthly retirement benefit (as calculated when they retired and entered DROP, plus any applicable cost-of-living increases).

Eligibility

Eligible FRS members may participate in DROP when they are vested and have reached their normal retirement date. A “normal retirement date” is the earliest date at which they become eligible for full, unreduced benefits based upon age and/or service.

Enrolled in the FRS prior to July 1, 2011

- Normal retirement is age 62 with at least 6 years of service or any age with 30 years of service.

- Special Risk Class members, normal retirement is age 55 with at least 6 years of Special Risk service, or any age with 25 years of Special Risk service, or age 52 with 25 years of Special Risk/Military service.

Enrolled in the FRS on or after July 1, 2011

- Normal retirement is age 65 with at least 8 years of service or any age with 33 years of service.

- Special Risk Class members, normal retirement is age 60 with at least 8 years of Special Risk service, or any age with 30 years of Special Risk service, or age 57 with 30 years of Special Risk/Military service.

Get Help Planning for Your Best Retirement Now

Our Team of Professionals are Available to Help

Securities and investment advisory services offered through Brokers International Financial Services, LLC. Member SIPC. Brokers International Financial Services, LLC is not an affiliated company. This site is published for residents of the United States only. Representatives may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed until appropriate registration is obtained or exemption from registration is determined. Not all of services referenced on this site are available in every state and through every advisor listed. For additional information, please contact John Hargraves at (904) 600-9258.

¹Mutual Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing in Mutual Funds. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Check the background of your financial professional on FINRA’s BrokerCheck.