Built to Improve Outcomes

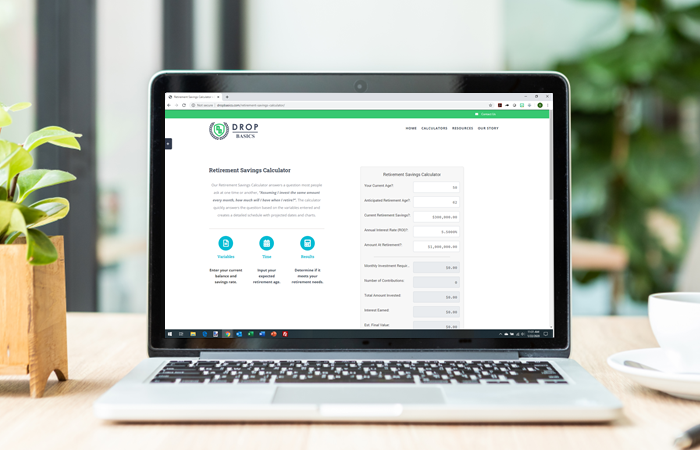

The DROPBASICS Retirement Planning Program was designed by career retirement plan service professionals to improve outcomes of participants in the Florida Deferred Retirement Option Program (DROP). The technology infrastructure provides a fully responsive experience, so users can access tools on any devices. Our intuitive user interface and core features enable users to easy access to information without the confusing and unnecessary bells and whistles of other websites.

Dashboard

The DROPBASICS Dashboard provides a simple wizard designed to allow users to quickly determine their retirement needs and steps to achieve them.

Review Choices

Our intuitive interface enables DROPBASICS users to change variables like retirement date, savings rate, or rate of return to review various scenarios.

Best of all, DROPBASICS offers personalized help for users who would like to speak to an advisor.

FLORIDA DEFERRED RETIREMENT OPTION PROGRAM (DROP)

The Florida Deferred Retirement Option Program (DROP) provides eligible Florida Retirement System (FRS) Pension Plan members with an alternative method for payment of their retirement benefits for a specified and limited period. Under this program, participants stop earning service credit toward a future benefit and their retirement benefit is calculated at the time DROP participation begins.

FREQUENTLY ASKED QUESTIONS

DROP News

Covering Valuable Topics for Florida Retirement System Participants

Get Help Planning for Your Best Retirement Now

Our Team of Professionals are Available to Help

Securities and investment advisory services offered through Brokers International Financial Services, LLC. Member SIPC. Brokers International Financial Services, LLC is not an affiliated company. This site is published for residents of the United States only. Representatives may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed until appropriate registration is obtained or exemption from registration is determined. Not all of services referenced on this site are available in every state and through every advisor listed. For additional information, please contact John Hargraves at (904) 600-9258.

¹Mutual Funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing in Mutual Funds. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

Check the background of your financial professional on FINRA’s BrokerCheck.